‘Snackification’: the Future of Mealtimes

The term ‘Snackification’ describes a growing trend of consumers replacing their meals with snacks (Euromonitor Passport 2020). While this trend is not new, it has led to continuous growth in opportunities within the snacking category as new innovations are constantly being introduced.

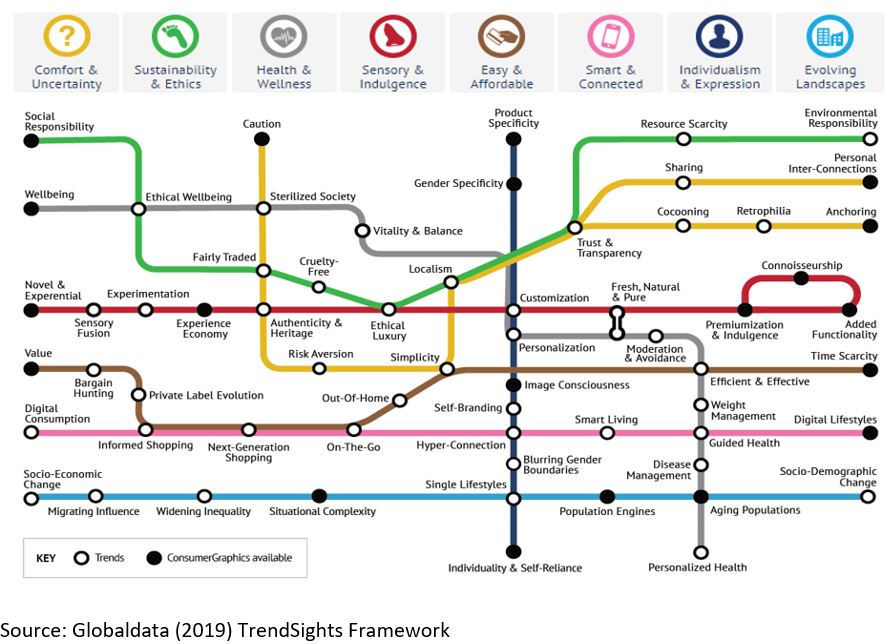

There are several factors behind this trend, such as changing lifestyles, demanding work lives, ease of consumption and the demand for new experiences. The rise in single households and the need for smaller quantities and non-perishables is also a contributing factor. Below are illustrated the eight megatrends that drive consumer choice. These can be broken down into a further 63 categories (GlobalData 2019)

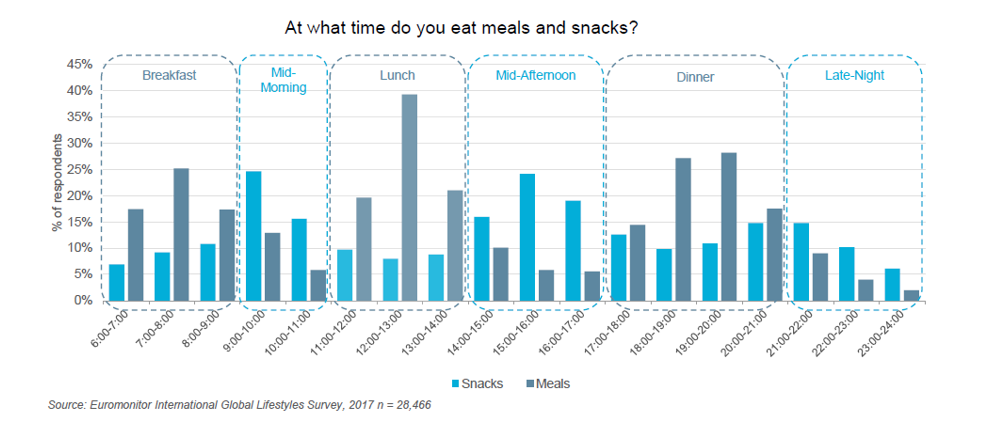

Mealtimes are no longer defined, as is traditional, as breakfast, lunch and dinner. Rather, an increase in food consumption can be seen throughout the day. Snack consumption dominates mid-morning and mid-afternoon periods and this is reflected in snack offerings to replace breakfast and lunch with products such as breakfast bars, drinkable yoghurt, breakfast biscuits, granola bars, crisps and mixed nut and seed items.

In the evening, consumers look towards products that satisfy their appetites and in addition, are fairly easy to prepare. Therefore the snack category loses out to meal kits, ready-made meals in retail and foodservice delivery.

Innovation can be seen with the introduction of healthier options. Other products offer extra benefits such as boosting energy or the immune system. Reports show that from 2013-2018, savoury snacks claiming health and wellness attributes grew at a CAGR of 1.3% (GlobalData 2020). The growing demand for such snacks is mainly driven by shifts in lifestyles, in particular those of individuals within the urban workforce who face time pressure and are looking for convenience during their busy schedules. The products below reflect this change: a ‘Pocket Latte’ (US), which claims to boost energy levels, and ‘Organic Blue Corn Popcorn with Shea Butter’ (Poland).

During the covid-19 pandemic, consumers are increasingly purchasing products that benefit the immune system and provide healthier alternatives (GlobalData2 2020). This trend will most likely continue after the pandemic as consumers look towards their health through diet, exercise and choosing appropriate products. There has been a rise in comestibles claiming health benefits from their protein and fibre contents.

Crisps, which have been traditionally viewed as an unhealthy savoury snack now include various types of vegetables and baked varieties. Some products are even suitable for vegans. Originally made only with potatoes, crisp brands now offer various vegetable options such as beetroot, carrot, sweet potato, lentils and even fruit. Below can be seen ‘Banana Joe Thai Sweet Chili flavoured banana chips’ (Lithuania) which is a vegan product free from nuts, GMOs and artificial flavours. ‘Go Pure Classic Potato Chips with Hibiscus & Sea Salt’ (Italy) is a brand made from organic potatoes. It also offers an exotic twist by adding hibiscus flavouring.

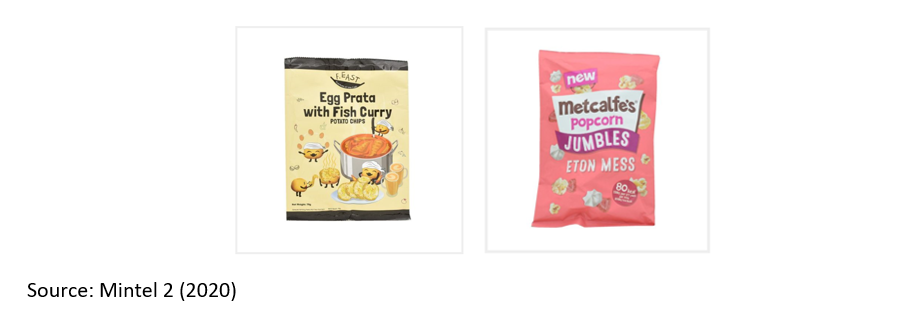

Other innovations include exotic combinations looking to appeal to consumers interested in different sensory experiences. Normally, the flavours that appeal to the local market have already been long-established. Examples of this are below: Egg Prata with Fish Curry Potato chips (Australia) and Eton Mess popcorn (UK).

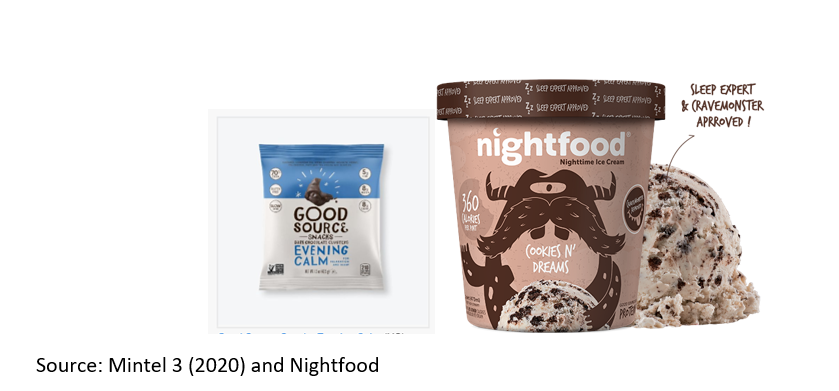

Some brands have even gone further by adapting their product to a certain time of the day (e.g. before bed or after the gym). A number of snacks incorporate botanicals such as lavender and chamomile, which claim to promote relaxation and induce sleep. Below ‘Good Source Snacks Evening Calm’ (US) contains dried cherries and lavender. ‘Nightfood’ ice cream is another brand that promotes snacking before bed, claiming that night-time cravings are hardwired and they have a guilt-free solution which has been scientifically developed to be ‘sleep-friendly’ (Nightfood).

The future of snacking remains bright with sales of packaged snacks projected to increase by 11% from 2019 prices over the period 2019-2024 (GlobalData 2019). Although this is definitely a positive trend, competition from other convenient food categories continues to grow as retail stores increasingly become local hubs for prepared food and foodservices. Packaged snacks will then have to compete alongside freshly-made food within the same physical location. In order to stay competitive, snack brands need to promote their ease of use and be available in various locations (or online) for consumers to purchase. Dietary and health trends are constantly changing and brands need to be aware of changes in tastes and demands. Those who remain in the market over time will be those who invest in innovation.

References:

• Euromonitor Passport - Snackification: Snacks, Meals And The Future Of Blurred Eating Occasions – January 2020

• GlobalData - Opportunities in the Global Savory Snacks Sector – December 2019

• GlobalData 2 - Coronavirus (COVID-19) Case Study: Healthier Snacking – April 2020

• Mintel - The Future of Salty Snacks: 2020 – January 2020

• Mintel (2)- A year of innovation in salty snacks & fruit mixes – March 2020

• Mintel (3) - Snacks in a post-COVID-19 world – May 2020

• Nightfood - https://nightfood.com/why-nightfood/