Joe Burke, Senior Manager Meat, Bord Bia – The Irish Food Board

Market review

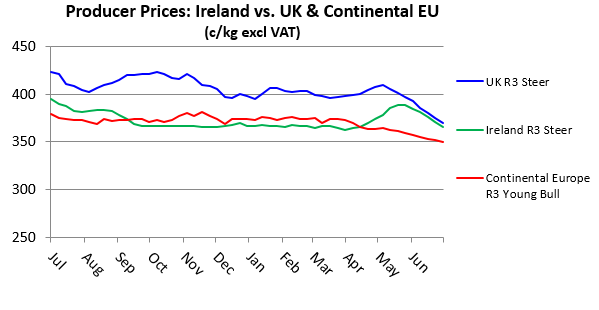

Having passed mid-year, now is an opportune point to review the prices paid by Irish meat plants during the first half of 2019, against the cattle prices recorded across key markets. To-date during 2019, the Irish R3 steer price has fallen by an average of 6%, or 24 cent per kilogramme behind last year’s levels, with returns averaging €3.71/kg (excl. VAT). Other categories have recorded more dramatic declines, and returns for R3 young bulls and O3 cull cows have been 10% and 16% lower, respectively.

Until the end of April, Irish R3 steer prices recorded very little change from week-to-week, at very close to €3.65/kg (excl. VAT). There was a steady recovery during the month of May, with prices reaching €3.89/kg (excl. VAT) by the end of that month. However, the past six weeks have seen successive declines of almost €0.05/kg per week, bringing prices to their lowest level of the year to-date.

By comparison, the UK R3 steer price has averaged €3.98/kg during the first half of 2019. Over the past two months however, British cattle prices have decreased sharply. As a result, the price differential between Irish and UK steers has contracted to less than €0.05/kg. This reflects significant Brexit-related uncertainty impacting on both market demand and supply. For example, beef sales by UK retailers recorded a 3% decline for the three month period to the end of May. As in Ireland, British farmers have been marketing their cattle earlier this year in fear of further trade disruption, and so slaughtering’s are running ahead of forecasts. Imports of beef into the UK have been 10% lower to-date, although Ireland has maintained a 78% share of the total volume.

Elsewhere around Europe, beef producers have also faced lower prices. In general on the continent, male cattle are finished as young bulls. For the year to-date, the weighted average R3 young bull around continental Europe was €3.67/kg. Until late April, the EU average young bull price was slightly ahead of the Irish steer price. Recent European prices have also been somewhat weaker, with R3 young bulls averaging €3.44/kg in Germany, €3.56/kg in Spain, €3.72/kg in France and €3.79/kg in Italy.

Composite cattle prices

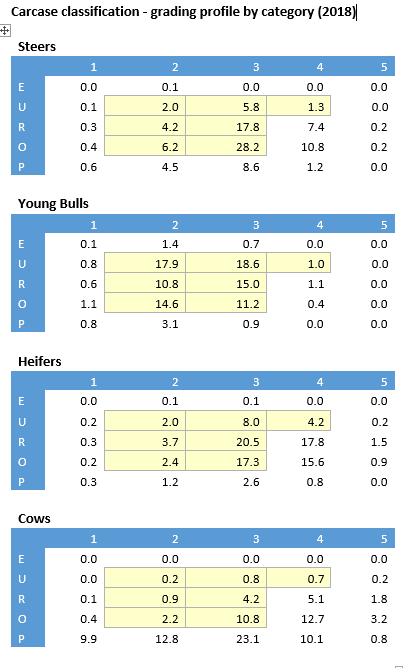

As outlined, the performance of cattle prices has traditionally been assessed by comparing the Irish R3 steer price at a point in time with the prevailing prices of R3 prime male cattle (steers / young bulls) across key markets, such as the UK and continental Europe. However, Bord Bia recently undertook a more detailed analysis which takes into account the prices paid for each of the different categories of animals and grades.

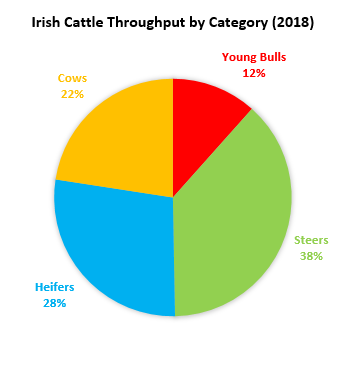

The first part of this exercise was to carry out an analysis of the 2018 cattle kill in Irish meat plants, based on the percentage of animals in the different categories (steers, young bulls, heifers and cows) and the main carcass grades. Using these values, an Irish “composite cattle price” can be calculated, which equates to the average price per kilo paid for all animals slaughtered in Ireland on a weekly basis. Importantly, looking at the first 6 months of 2019 compared with last year’s levels, average prices have fallen by a dramatic 8.4% when all of the different categories and grades are taken into account.

Export benchmark price

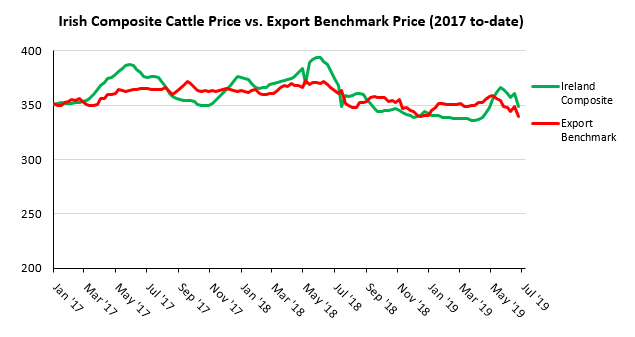

In order to come up with a representative market indicator with which to compare the Irish price, Bord Bia did an in-depth analysis of the cattle prices in our main export markets. This effectively involved producing a composite price for each of the individual markets, using the prices reported for the different carcase categories and grades on a weekly basis by the European Commission. Weightings were then applied according to the markets’ relative importance for Irish beef exports. For example, UK cattle prices were given a weighting of 52%, reflecting the proportion of Irish beef sent there in 2018. Similarly, % weightings were applied to cattle prices across EU markets including France, Italy, Germany, the Netherlands and Sweden, in order to arrive at an ‘Export Benchmark Price’. Essentially, this equates to the average price that Irish producers would theoretically receive, if their cattle were priced according to the prevailing carcase prices across the major export markets.

By comparing the Irish composite price with the export benchmark price over recent years, we can see that prior to autumn 2018, the Irish beef sector had performed relatively strongly, with average returns exceeding the market indicator for much of that period. However, over the past nine months, the analysis indicates that if Irish cattle were sold at prices representative of our main export markets, in general they would have achieved a higher value than what was actually returned.

Of course it must be acknowledged that this price comparison does not allow for transport costs or for a preference for the domestic offering in certain markets. However, these factors are also relevant at times when the prices paid exceeded the benchmark price.